What does the hottest stock in the S&P 500 do after skyrocketing more than any other large-cap stock on the market? Announcing a major stock split could be a good follow-up.

That’s exactly what Nvidia (NASDAQ: NVDA) is doing. Shares of the graphics processing unit (GPU) maker have nearly tripled over the last 12 months. Nvidia will conduct a 10-for-1 stock split after the market closes today. The stock will begin trading at a much lower share price on Monday, June 10.

But will Nvidia stock soar after its stock split? Here’s what history shows.

Good times ahead?

Stock splits change absolutely nothing about a company’s business or its growth prospects. All they’re guaranteed to do is increase the number of outstanding shares and lower the share price.

However, one reason why companies conduct stock splits is that the move can provide a nice catalyst. The idea is that some investors sit on the sidelines with a given stock when it’s too expensive for them to buy. But when the share price is lower, they’re more willing to purchase shares. This could especially apply to a highly followed stock such as Nvidia.

Is this what history shows? Yes, according to Bank of America‘s Research Investment Committee. It found that stocks have achieved total returns of 25% in the 12 months after announcing a stock split. By comparison, the S&P 500 rose around 12%, on average, during the same period.

But the story isn’t quite as good in recent years. Since 2010, stocks with splits have delivered a total return of around 18% during the 12 months following the announcement of a stock split, versus 13% for the S&P 500, according to a report by Statista based on data from Bank of America, Bloomberg, and Global Financial Data.

What Nvidia’s stock-split history reveals

Has Nvidia delivered outstanding gains after its previous stock splits? The company has split its stock five times in the past. Let’s look at what happened before and afterward in each case.

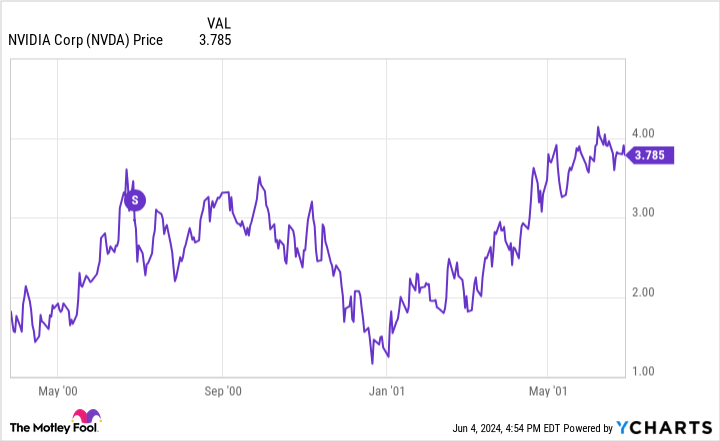

On June 27, 2000, Nvidia conducted a 2-for-1 stock split. In the weeks leading up to the split, the stock steadily vaulted higher.

However, Nvidia’s shares fell immediately after the stock split and were down significantly by year-end. One year after the split, the stock was up quite a bit. There’s no way to know for sure if this gain was directly attributable to the stock split, though.

Nvidia conducted another 2-for-1 stock split on Sept. 12, 2001. This time, the company’s shares fell both ahead of and immediately after the split. The stock rebounded during the rest of the year. However, it then began a steep decline (as did the broader market).

Several years passed before Nvidia’s next 2-for-1 stock split on April 7, 2006. In this case, the stock rose before the split and then fell shortly afterward. Following a sharp sell-off, Nvidia’s shares bounced back. Still, a year later, it was up barely over 1%, while the S&P 500 was up more than 13%.

The next year, Nvidia conducted its first 3-for-2 stock split. The stock again climbed ahead of the stock split. The good times didn’t last for long, though. Nvidia soon plunged with a much worse decline than the S&P 500.

Nvidia conducted a 4-for-1 stock split on July 20, 2021. This was another good news/bad news scenario.

The chipmaker’s shares jumped both before and immediately after the stock split. A year later, though, Nvidia’s share price was lower than when the split occurred. However, Nvidia still managed to outperform the S&P 500 during this period.

A better reason to buy Nvidia stock

Can we draw any solid conclusions from Nvidia’s stock-split history? Unfortunately, no.

I wouldn’t put too much faith in the Bank of America findings about the long-term outperformance of stocks after announcing splits, either. It’s possible that the individual stocks that beat the S&P 500 after announcing stock splits would have done so, even without splitting their shares.

There’s a much better reason to buy Nvidia stock than its stock split, anyway. The demand for high-powered chips to train and run artificial intelligence (AI) models continues to soar. Nvidia is the undisputed leader in the AI chip market, and its rapid speed of innovation seems likely to keep the company at the top for the next few years.

This should translate to strong earnings growth. When earnings grow, share prices typically follow — stock split or no stock split.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005… if you invested $1,000 at the time of our recommendation, you’d have $750,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of June 3, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. Keith Speights has positions in Bank of America. The Motley Fool has positions in and recommends Bank of America and Nvidia. The Motley Fool has a disclosure policy.

Will Nvidia Stock Soar After Its Stock Split? Here’s What History Shows. was originally published by The Motley Fool